Non-VC Funding Options

Raising money from VCs means that your business must one day become an unicorn. That’s just how VC math works [1][2]. But what if you don’t like the low odds of building a unicorn? What if you’d love to build a unicorn but you’d also be happy with a 50M business or a 5M business? That type of non-unicorn business, one that’s a cash cow and one that would make you - the founder - a life changing amount of money, isn’t interesting to VCs.

Additionally, not raising from VCs early on preserves optionality - you can always raise later! So, what are your options for start-up capital if you don’t want to go down the VC path at the outset?

Well, if you’re building rockets and you’re not already rich, then I’m sorry you likely have 0 options other than venture capital. But for the rest of us, there are plenty of options. The first and most obvious one is to draw down your personal savings. This is a great option - work for a few years, save up some money and then, start a business.

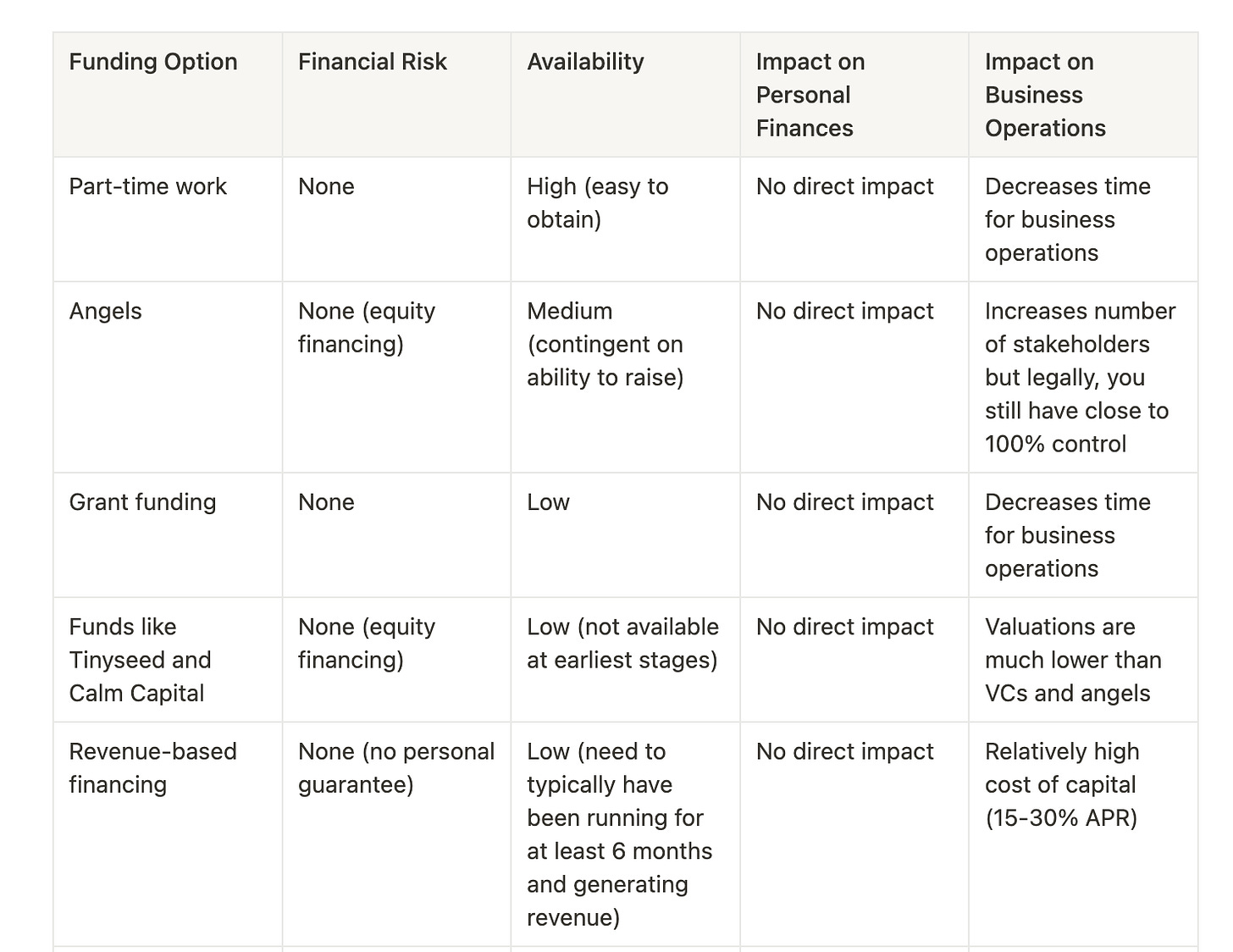

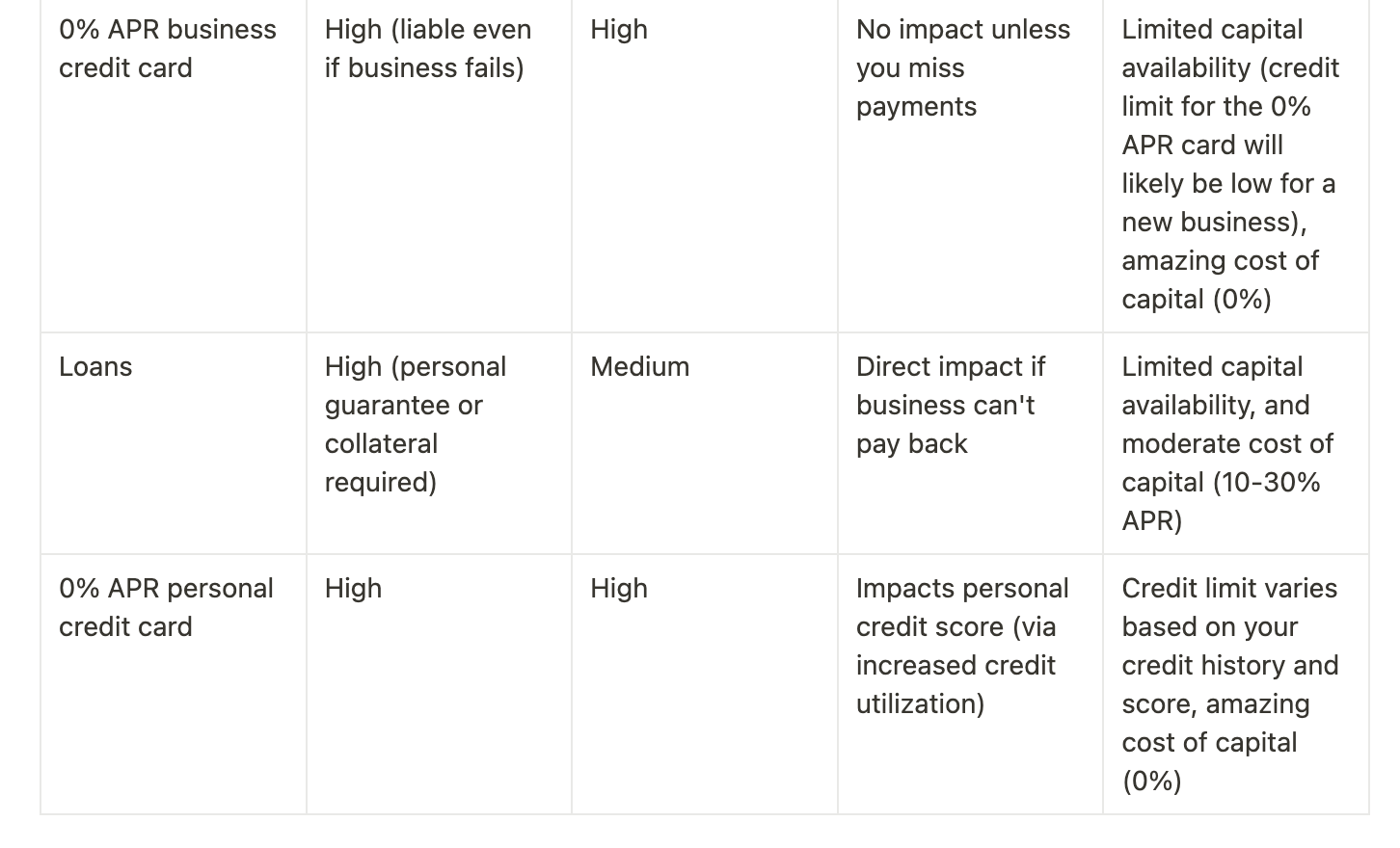

Below are some other options. Following that, I’ll share my personal journey of starting my second startup, WhimsyWorks, Inc. (now at 110K ARR) and how I funded it using a combination of different mechanisms.

My journey with WhimsyWorks, Inc.

Over the past several years, I’ve tried to start a business while doing part-time work, sometimes even at significantly less than 40 hours of work and for various reasons, I have never made much progress.

In November 2022, I decided it was time to take the leap and pursue something full-time. At that time, I probably had 6-8 months worth of savings in cash. Important to note that I had a lot more in investments and other less liquid assets. This will affect my decision making when it comes to funding.

To speed run the story of how things went over the first 6 months: I started working with a co-founder in January 2023. We tried a few different ideas. One (Pico) started really taking off in May 2023, a month or so after we released it. And in just a couple of weeks, we went from essentially $0 MRR to $7000 MRR. We got really lucky! Unfortunately, $7K a month is still far from enough to live off for 2 people in NYC after expenses and taxes.

Soon after, a bit later in May, I decided to stop working with my co-founder. Because we both owned 50% of the company, I couldn’t just fire him (or him me). After some negotiations, I offered him a buyout (legally, a severance payment for his resignation). I’d pay him $30,000 and an ongoing 15% revenue share for a year.

By that point, 6 months in without taking any money out of the company, I was running pretty low on my personal savings but it was a good decision because after the buyout, I’d own an asset that was generating ~$7K per month, which would be close to break even for me.

But I had to find the $30K first.

The company had about $12K in cash from revenue in the last 2 months. For the remaining amount, I personally loaned the company the money. To get some of that cash immediately, I did an IRA rollover (you can rollover back into the same IRA within 60 days and incur no penalty). Then, I got myself a new 0% APR card and started moving a lot of personal expenses to the card. Even though my credit limit was only $11,000, I was able to essentially put the money I took out back into my IRA within the 60-day rollover period.

Racking up expenses on my credit card did affect my credit score quite a bit and I wasn’t all that happy about that.

The company was finally able to close out the $18K loan from me in January 2024 using the revenue generated over the latter part of 2023.

Other funding options I’ve explored:

I recently got a 0% APR business credit card. With a paltry credit limit of $3000, it’s not a lot of money but the flexibility of having a credit line is really great and it helped me reduce my personal credit balances.

I also took out a $4000 QuickBooks Capital loan (was offered $6000) at an astronomical interest rate of 36% APR. However, the interest only accrued while the loan was open. I paid it back in a month and ended up paying only 3% interest on that amount. Nice bridge financing for some things I needed to pay for at that time.

I’ve been offered Stripe revenue-based financing twice. The interest rates ranging from 20-25% were just way too high for me.

I applied to TinySeed once and got rejected. Even if I had gotten in, I probably wouldn’t have taken it (giving up 10% for 120K is too expensive in my opinion).

I just applied to the Github accelerator (grant funding).

As you can see, I’ve explored a lot of the funding options. My personal financial situation (i.e. that I can always sell some investments to cover a loan) means:

I care a lot about cost of capital

Don’t care about the personal guarantee

Because of this, revenue-based financing for instance is very unattractive to me.

Ultimately, the best options for you will be different depending on your financial situation. A spreadsheet is a good place to start to get to the optimal path.

Funding for startup business